4 situations that will help select from unsecured and safeguarded fund

With lenders now offering individuals unsecured and you can secured loans, there is certainly individuals questions who visited the head- exactly what are secured finance, what are signature loans, and ways to select from the two version of funds. Keep reading understand the brand new answers to make an informed financial decision.

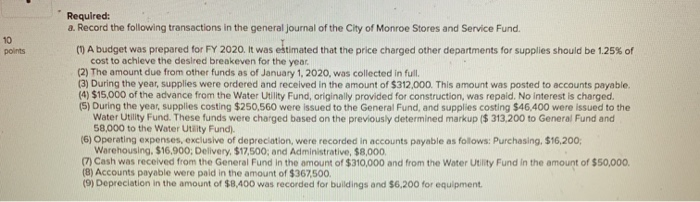

What are secured loans?

Secured personal loans seek protection from you are known as security. This really is an article of value that financial holds rights so you’re able to through to the financing are paid. Loans up against houses, gold, property and other real possessions was characterised as secured personal loans. Your failure to settle the loan can lead to the lender attempting to sell your own coverage to recoup the amount loaned. Interest rates and processing fees was lower in the way it is from secured finance.

Exactly what are personal loans?

Signature loans none of them equity. He is given centered on your credit score and you will money and you may is choices eg unsecured loan and student education loans. Their controlled installment of borrowing from the bank in earlier times, processing your taxation statements promptly, that have a constant work or any other products constantly render your qualified having a personal loan. Personal loans always include high rates of interest and control charges as bank, in such cases, takes on improved chance.

Opting for between secured finance and you will signature loans

And then make a knowledgeable choice about selecting secured loans or unsecured financing, here is how you might choose which kind of financing is the greatest suited for your position.

step one. Your comfort which have equity

Collateral ‘s the head factor that allows you to get a secured financing. Such as, it is possible to hope your house so you can borrow funds first off an excellent business. Or you may guarantee the assets (such as for instance FDs or any other securities) to get money. Sometimes, lenders might have the very least worth to suit your security less than and that they don’t accept shelter. And additionally, the value of their defense could well be higher than the mortgage count accessible to you. Staying these products at heart, determine whether pledging safeguards works in your favor. If you are not introducing you to ultimately risk because of the pledging an excellent worthwhile asset, you might opt for that it financing.

2. Your own economic requirements

Secured personal loans provide high mortgage quantity towards the a flexible tenor away from to twenty five years in case there is financial, such as for example. At exactly the same time, a personal loan try approved to you personally based on your earnings, credit history and other lender-specific qualifications words. Ergo, the mortgage matter and you can tenor is minimal and you may smaller in comparison to a secured loan. Therefore, when you are applying for a loan, maintain your demands in mind and choose the type that most readily useful provides your goals. Such, to shop for electronic devices and you can seats for your new home with a keen unsecured financing can be helpful as you’re able to rapidly pay-off your own loan having fun with funds from your revenue.

step 3. Your own timeline getting appointment your needs

A consumer loan is a collateral-100 % free financing. So, your get they towards the easy and terminology and you can accessibility it without delay. This makes such finance alot more expert for immediate means such as for example a wedding about family, hospitalisation costs, and you may house fixes. Although not, if you want to purchase company extension otherwise purchase an effective the latest premise for the businesses, you may need large financing for a lengthier tenor. In this situation, a protected loan such as for example that loan facing assets concerns your own services. A personal loan is a guarantee-totally free loan. So, your submit an application for it to your simple and words and you may supply it without delay. This makes these types of funds much more expert to possess immediate demands instance a wedding regarding relatives, hospitalisation can cost you, and you will household solutions. However, when you need to invest in team expansion or purchase good the new properties for your businesses, you may need good-sized fund for an extended tenor. In such a case, a protected mortgage instance a loan facing possessions concerns your support.

cuatro. Your credit rating

After you borrow an equity-free mortgage, your credit installment loans direct lenders online rating was tall as it’s the primary means a lender is also court your own creditworthiness. Here, a good credit score significantly more than 750 will bring you a premier-value financing approve towards a competitive interest rate. While doing so, close to your credit score, the investment is the vital thing to getting your a substantial sanction toward flexible loan words when you acquire a secured mortgage. Thus, when your credit history was under level, it may be less costly on the best way to choose a great safeguarded mortgage. When your needs are not urgent, you can even alter your credit score following acquire a keen personal loan.

Skills this type of loans will assist you to select the right option for your needs, giving you the easiest and quickest way to tackle arranged and you can unexpected expenditures.

DISCLAIMER: Whenever you are care try taken to revise all the information, points, and properties included in or available on all of our webpages and you will related platforms/other sites, there might be inadvertent inaccuracies otherwise typographical problems otherwise delays into the updating what. The materials within webpages, and on related websites, is for site and standard information objective as well as the info stated on particular equipment/services file should prevail if there is any inconsistency. Members and profiles should search expert advice in advance of acting on new base of the suggestions contained herein. Excite just take the best choice in terms of one product otherwise solution after checking out the related device/solution file and you will appropriate fine print. However if one inconsistencies seen, delight simply click arrived at you.