Financial Publication. Bringing a DACA financial to locate property

The way to get home mortgage

Jim Quist may be the opted President and you can Originator away from NewCastle mortgages. Jim did when you look at the mortgage globe for over twenty years. Their goal is to try to assist household people discover given information they should close to the domestic purchase confidently.

You need to see household, however the lender refuted your home application for the loan as the you may be inside new Deferred Step for Young people Arrivals program.

Try not to call it quits your dream of home ownership. I shall assist you the manner in which you could get financing to help you purchase home when you have DACA updates. Look at this blog post to have solutions:

has not yet prevented you. We have closed way more mortgage loans when you look at the 2020 to own DACA receiver than i performed just last year. Notice an effective DACA loan punctual? Proceed with the procedures during the finally part of this article to observe the method that you might get registered in 2-date and you will close in 15-months. You can cellular phone myself myself at 855-610-1112 otherwise play with today on the web.

Was I qualified to receive a home loan when the I am toward this new DACA program?

Sure. Home financing is going to be got on your part whenever you are to your DACA program, however your alternatives for investment try limited. Their DACA status enables you to ineligible for many kinds of funds.

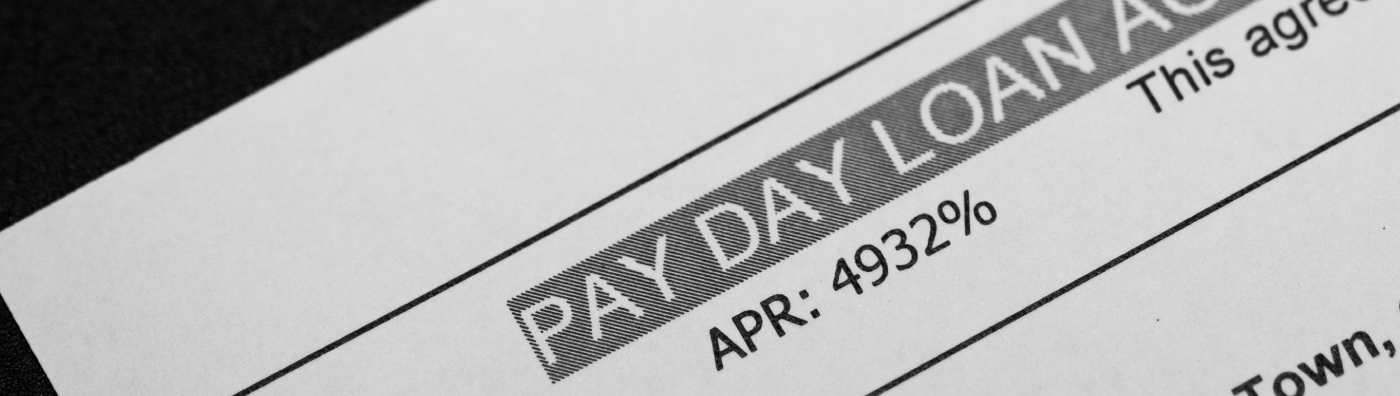

A payday loan Carbon Hill legal, non-permanent resident is actually eligible to more types of mortgage loans, along with FHA and you can dated-designed funds. Any time you show that you are an excellent compatible resident with the U.S., then chances are you meet with the abode needs.

But, DACA was uncertain, this new providers you to set principles to have mortgage programs interpret they in different ways, and you can considering certain mortgage policymakers, DACA cannot reveal that you’re an appropriate citizen into the You.S.

Can DACA recipients get FHA funds?

Zero. DACA recipients is actually ineligible having FHA finance as the HUD told you ergo from inside the A web page. The new HUD authoritative created, “because DACA cannot consult updates which is legal DACA readers are nevertheless ineligible to have FHA loans.”

Unsecured loan company, such as for example NewCastle mortgage loans, pursue HUD’s guidelines. Let me describe. You get a keen FHA mortgage with a loan provider a lender, credit connection, otherwise financial organization. The lending company is in charge of making sure the loan touches version of criteria put of the Government Houses Authority (FHA). This new FHA belongs to HUD, the newest Company out-of Housing and Metropolitan developing. HUD helps to make the legislation when it comes to FHA loan program.

The newest page on the other hand shows the U.S. Congress, perhaps perhaps not HUD, contains the authority to find out immigration and citizenship status. Meaning in case you are DACA you simply can’t score a keen FHA loan until the You.S. Congress describes your own residence reputation on the bureaucrats at HUD. already, Congress are concentrating on the fresh Homeownership to possess Dreamers Operate. In the event that Work gets guidelines, DACA receiver could have usage of FHA mortgage loans, providing you so much more options for mortgage loans.

In comparison with most other mortgage loans, an FHA loan, would assist you to obtain household when you yourself have a tiny downpayment or your borrowing isnt a. For-instance, that have an FHA financing you might buy a-1 in order to 4 product house or apartment with a repayment that is down out-of step 3.5% prior to a credit rating just 580.

Normally DACA receiver enjoys traditional finance?

Yes. DACA users meet the criteria for popular fund. Policymakers confirmed it within the out-of 2019 june. The Non-Resident Borrower Qualifications guide will bring more info, as well as types of compatible documents.

DACA recipients may use a timeless loan to acquire or refinance a 1 to 4 unit home. Our house will likely be your property that’s primary and may have:

- an advance payment off no less than step three% for the family home that is unmarried

- an excellent 620 or higher credit score

- secure work record and you will earnings which is planning embark on.