I think the most significant problem with tough currency loan providers is the notion of financing-to-very own

Possibly into the second attempt you should buy one to mortgage, but you have got to have time to fix the house

Why don’t we talk about exactly what loan-to-own means for one minute because it is very particular an odd design. Just what they have been undertaking was they’re making the financing towards the full purpose you never, actually, ever standard. You simply afford the interest thereon loan and boy it like both you and that is high. The hard money lenders have a tendency to indulge toward a unique business model that’s entitled loan-to-very own. Today what is actually financing-to-individual indicate? It indicates that they build that loan with the expectation, for the fantasy that you’ll default and they’re going to make the possessions back, right after which they’re going to work they and or sell. So it function you and the bank commonly aligned in the your goals. The financial institution are aligned to you. The financial institution just desires to manage to get thier notice. Needed you to definitely ensure it is. They require you to 1 day state, “Hey, here is my last percentage.” And additionally they say, “Hey, best wishes you have it paid back, very have a good life.”

However the mortgage-to-individual bank enjoys an alternate mission. They require that come in and state, “I am unable to make repayments.” Then they say, “Yeah, you failed to make the costs now the house or property try exploit.” That is scary if the financial therefore don’t have the same plan because what happens if there is trouble? What if we have an economic downturn? Imagine if you have got a great Lonnie Specialist which pulls six house out of the park at exactly the same time? What goes on? The financial institution will usually assist you. Visit the lending company, you happen to be sincere. Your say some tips about what occurred and you can is as to the reasons. Really banking companies will attempt and you may fold more than in reverse to match you, not the mortgage-to-individual lender. That is the starting they were looking forward to to get the house or property from you. So what does it indicate? This means hard currency credit merely is actually hard. Really don’t actually know if i perform very state this is the material I would like to try.

First another type of tip for the capital. Perhaps not vendor, maybe not financial, not friends, not difficult currency. It’s called the loans Columbia Learn Book which have Solution. Today why does that actually work? What might you to end up being? Better, basically significantly less than Learn Lease having Option, you grasp lease the house or property so that you control the latest property and you spend one to monthly fee for the whole assets and after that you have an amount where you can easily purchase it. You may have a trigger rates considering almost any rate you pre-based. So now you might state, “What’s the purpose of you to definitely? What is delicious from the a king Rent that have Solution?” First several reasons why.

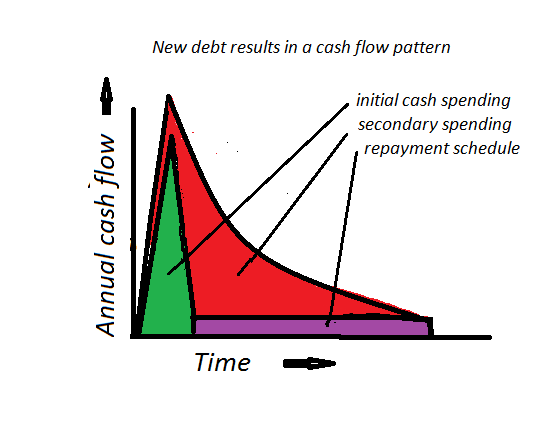

When you use of a lender what takes place is the financial cannot really would like the latest guarantee right back, that simply does not voice really enticing in it

Number 1, when the mom and you may pop music features a home that is not looking very a for the the financials. It provides the capability to develop that, to make the possessions a great deal more bankable. Perhaps you couldn’t get that mortgage while the bank told you, “Today wait one minute fellow, you explained you happen to be to find that it issue to have $eight hundred,000. You tell me it is possible to make $29,000 per year away from net gain but today it’s simply to make $10,000.” Possibly for this reason you did not get the financial loan. How do that actually work towards Grasp Book having Alternative? Better, you’re going to wade truth be told there and fix any sort of are making the economic thus bad to help you upcoming return later and are again. How can it operate in real life? Well generally what you carry out is you build your costs and you will while you’re deciding to make the payments generally speaking your enhance whatever’s completely wrong. Whatever’s incorrect perhaps you need to improve the rents doing field. Maybe you need flames the latest movie director having unbelievably overpaid. Perchance you must fix water leak that is charging $3,000 a month. Perchance you need certainly to fill several Camper loads. you need to do points that are not awesome funding intense.