Treasury shares can always be reissued back to stockholders for purchase when companies need to raise more capital. If a company doesn’t wish to hang on to the shares for future financing, it can choose to retire the shares. These earnings, reported as part of the income statement, accumulate and grow larger over time. At some point, accumulated retained earnings may exceed the amount of contributed equity capital and can eventually grow to be the main source of stockholders’ equity. The debt-to-equity ratio, or D/E ratio, is determined by dividing the total liabilities of the business by the equity held by shareholders.

How Does the Accounting Equation Differ from the Working Capital Formula?

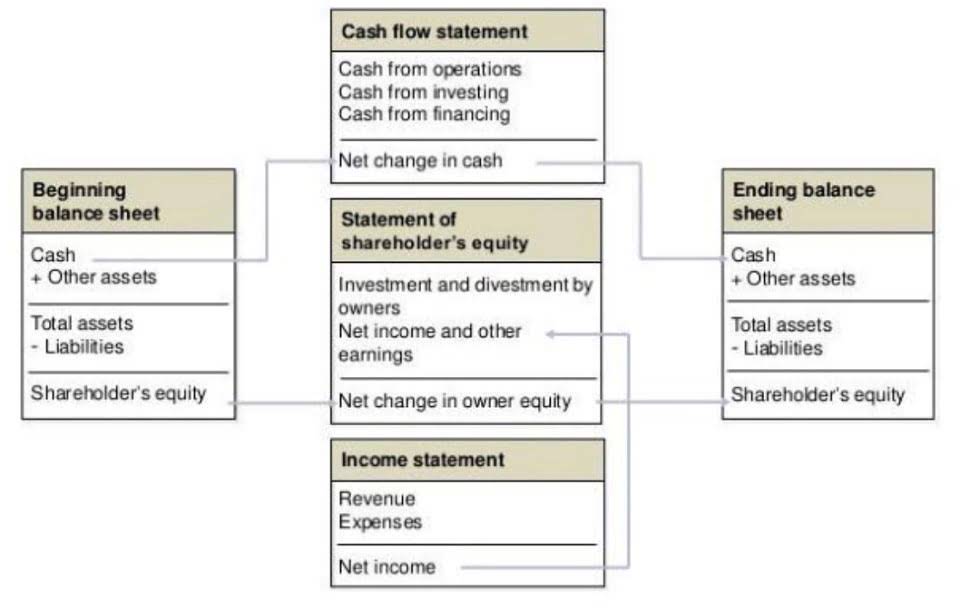

The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. The stockholders’ equity, also known as shareholders’ equity, represents the residual amount that the business owners would receive after all the assets are liquidated and all the debts are paid. Shareholder equity is also known as the book value of the company and is derived from two main sources, the money invested in the business and the retained earnings. The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity.

Introduction to the Accounting Equation

You can see the shareholder’s equity line on the balance sheet completed in the example screenshot of a financial model that is shown below. This is the sum that remains for the benefit of the company’s shareholders after all liabilities have been subtracted from the assets. While long-term assets are less liquid, retained by the company for at least a year, or cannot be converted to cash within a year, current assets are liquid and can be converted to cash within the year. Accounting software is a double-entry accounting system automatically generating the trial balance. The trial balance includes columns with total debit and total credit transactions at the bottom of the report.

What is an Adjusted Trial Balance and How Do You Prepare One?

Investors usually seek out equity investments as it provides a greater opportunity to share in the profits and growth of a firm. As per the formula above, you’ll need to find the total assets and total liabilities to determine the value of a company’s equity. All the information required to compute company or shareholders’ equity is available on a company’s balance sheet. Owner’s equity is the amount that belongs to the business owners as shown on the capital side of the balance sheet, and the examples include common stock, preferred stock, and retained earnings. The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity.

As per the company’s balance sheet for the financial year ended on March 31, 20XX, the company’s total assets and total liabilities stood at $3,000,000 and $2,200,000, respectively. Based on the information, determine the stockholder’s equity of the company. The amount of cash received from investors who bought equity stocks in the company, less any dividends paid to shareholders, is equity formula accounting shown as shareholder’s equity on the balance sheet. This includes all of the cumulative profits earned by the company over the years. It is possible to determine a company’s shareholders’ equity by deducting its total liabilities from its total assets, both of which are listed on the balance sheet.

- In this case, it’s just the value of all your assets (cash, equipment, etc.) minus all your liabilities .

- The accounting balance sheet formula makes sure your balance sheet stays balanced.

- For sole traders and partnerships, the corresponding concepts are the owner’s equity and partners’ equity.

- Therefore, the stockholder’s equity of PRQ Ltd as on March 31, 20XX stood at $140,000.

- If both ledgers of your balance sheet don’t match, there may be an error.

Owning equity will also give shareholders the right to vote on corporate actions and elections for the board of directors. These equity ownership https://www.facebook.com/BooksTimeInc/ benefits promote shareholders’ ongoing interest in the company. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position. Since equity accounts for total assets and total liabilities, cash and cash equivalents would only represent a small piece of a company’s financial picture.

This formula is known as the investor’s equation where you have to compute the share capital and then ascertain the retained earnings of the business. There tends to be significant reliance on the subsidiary in this regard. Moreover, there is time and effort required in doing additional steps like that of equity accounting, and hence the firm needs to appropriate resources accordingly in this regard.

Everything to Run Your Business

- The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity.

- It can also provide the company with more flexibility and a potentially lower cost of capital.

- Negative brand equity is rare and can occur because of bad publicity, such as a product recall or a disaster.

- Here we’ll go over exactly what equity is, how you actually get it, what it has to do with things like “stock” or “shares,” and what all of this means for your business.

- Read end-to-end for a thorough understanding of accounting formulas or use the list to jump to an equation of your choice.

- With the accounting equation, you can better manage your business’s finances and evaluate your business transactions to determine whether they’re accurately reported.

- Profits made by a company that are not paid out as dividends to stockholders (shareholders) but rather are set aside for reinvestment in the company are known as retained earnings (RE).

If both ledgers of your balance sheet don’t match, there may be an error. The value of $60.2 billion in shareholders’ equity represents the amount left for stockholders if Apple liquidated all of its assets and paid off all of its liabilities. When speaking of actual equity, you are effectively taking into account the whole market value of the company’s assets minus the sum of its liabilities. The overall equity (market value) in this situation will not be equal to the whole shareholder equity (book value).

Using accounting formulas to monitor your company’s financial health

Incorrect classification of an expense does not affect the accounting equation. Understanding how the accounting equation works is one https://www.bookstime.com/ of the most important accounting skills for beginners because everything we do in accounting is somehow connected to it. Remember, your net income is made up of your total revenue minus your expenses. If you have high sales revenue but still have a low profit margin, it might be time to take a look at the figures making up your net income.