The seller-Reduced Rates Buydown: Your own Wonders Firearm During the A premier-Rates Ecosystem

For the a recent blog post, we discussed the fresh particulars of mortgage factors (otherwise discount products) and whether or not it is practical to blow them to reduce steadily the rate of interest on your own home loan.

As rates of interest continue steadily to go up, such buydowns get a lot more of an interest from conversation certainly one of homebuyers and you will sellers, and their agents and you can lenders.

For these people have been toward cusp away from qualifying getting home financing to start with, rising pricing you certainly will enchantment crisis and get away from all of them out-of obtaining quantity of financial support wanted to get property.

This may and become an issue to own sellers. According to a current blog post by the Financial Development Each and every day, real estate loan software only struck its lower accounts when you look at the 22 decades.

Even in the event the audience is however officially for the an excellent seller’s market (more need for homes than supply), this new tides was switching. Less people able to qualify for mortgage money means less people putting in a bid to the land. For those who are quickly to offer, this might indicate being forced to reduce the price of the home to attract accredited buyers.

Neither customers neither providers victory when rates of interest go up such as we are enjoying today. But not, there clearly was a method for your financial and you will home class to the office to one another to produce a winnings/Profit scenario for all inside it the vendor-Paid off Rates Buydown.

What’s A merchant-Paid back Price Buydown?

Loan providers allow the vendor from a house to credit a portion of the continues to the family customer. This might be titled a merchant concession. Vendor concessions are often used to shell out a customer’s closing costs only, and should not be employed to advice about the advance payment.

What knowledgeable financial and real estate professionals know would be the fact seller concessions could also be used to pay home loan items and buy along the interest rate.

The complete suggestion into the supplier-paid back speed buydown is to get cash return about vendor to forever pick on the rate of interest. The majority of agencies and you will mortgage pros have a tendency to distribute owner fund so you can underwriting can cost you, escrow charges, and you will financing charges…not too many ones want to permanently buy down the attention rate towards mortgage and that reduces the new month-to-month mortgage payment.

Which Advantages from A seller-Reduced Price Buydown?

Within the a routine seller’s industry, where there are constantly several also offers into belongings and you can biddings battles certainly are the norm, it genuine. But as we mentioned above, rising interest levels is actually throttling value and you will leading to fewer financial applications particularly for higher-charged home.

When this is the case, the fresh new go-to help you solution is into seller to attenuate the brand new selling price of the house. However, this is actually maybe not the best way to wade. A supplier-paid down price buydown will in actuality result in significantly more earnings for both the customer And provider.

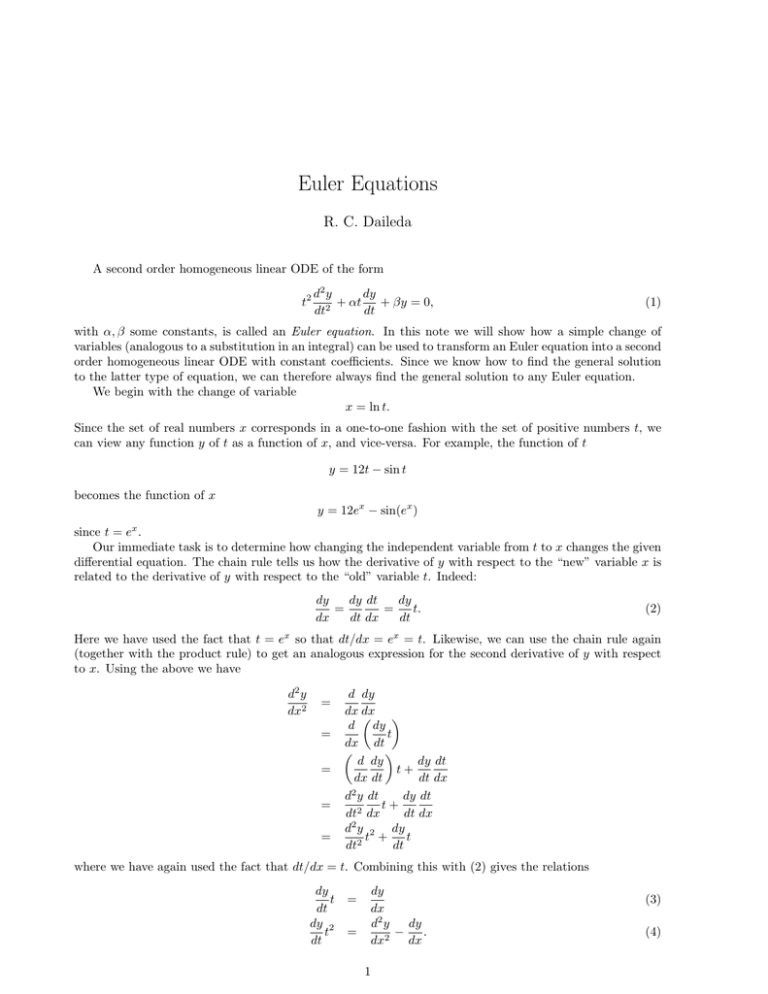

Lower than is actually a sample away from that loan comparison appearing choices for to invest in a $five hundred,000 domestic having fun with a 30-seasons fixed-speed home loan at the an effective 5.5% rate of interest.

Because of it example, let’s say the customer can just only be eligible for good payment of $step three,000. As you care able to see in the 1st line proving industry rate and you can price, the buyer wouldn’t be in a position to afford the house during the that it situation.

Rate Prevention Method

That it changes manage bring about specific discounts to your buyer, although requisite monthly https://paydayloansconnecticut.com/wauregan/ payment manage still be too high. This plan would also slow down the seller’s online profit by $20,000 a large amount.

Seller-Paid Price Buydown Means

Now evaluate what might happen in case your provider paid back 2 points to get down the interest rate by .5%.

Not merely do this one reduce the monthly payment sufficient to what the buyer you certainly will qualify for, it might can also increase the seller’s net gain $ten,500 compared to the price reduction means.

To take they one step then, the last line shows just how much the seller do now have to attenuate the cost of our home to arrive the same payment per month because rate buydown strategy $twenty seven,270, which is almost 3 times the price!

Lastly, by removing the pace, the consumer tend to understand even more coupons along side life of its loan not just upfront.

The conclusion

Deals from the rates and you can merchant concessions are included in all actual house exchange. Just what of many don’t realize would be the fact a provider-paid rate buydown method also provides a whole lot more masters for all parties inside it ultimately:

- Providing a significantly less than-market interest toward property usually draw in even more buyers

- Conserves the seller currency initial

- Saves the buyer money in tomorrow which have down costs and a lower life expectancy interest

- Assists keep home values on town

- Avoids new stigma out of a price reduction

If you would like for more information on the benefits of a seller-paid speed buydown strategy, or if you would like to discover a loan review comparable on one to a lot more than to suit your types of buy circumstance, fill out the form less than so you can demand a mortgage development visit with one of our experienced mortgage advisors.