Bringing a mortgage certainly is the most them

Though really steps in the home to buy feel remain deal with-to-face, there are many different stages in the method you’re able to do out of your https://paydayloanalabama.com/new-site/ home or office. One which just fill out an internet app, however, you would be best if you basic comment various online learning resources.

Begin by deciding on on the web recommendations information that may help you work through this new maze off capital an alternative household. Of a lot public and you may low-earnings communities are would love to pay attention to away from you.

Yet not, you can easily still need to supply the same intricate economic advice to an online bank you to definitely a stone-and-mortar financial would need

- The newest U.S. Institution out-of Property and Metropolitan Circumstances brings factual statements about looking, money, and keeping a home. Check out .

- InCharge Personal debt Possibilities counsels potential real estate buyers, educates and makes them with the to purchase processes. Go to and select Property Guidance throughout the directory of attributes, otherwise telephone call cost-totally free 877-267-0595.

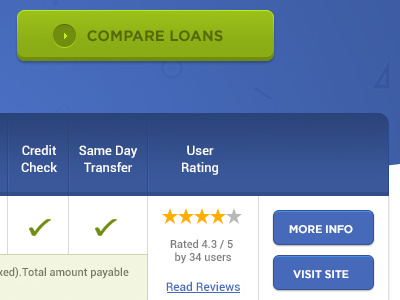

After you familiarize yourself with the procedure and you can conditions, you will be better willing to go through the personal lenders’ websites. Online lenders will tell you whenever they be involved in authorities-recognized lending applications. You might usually get interest estimates and you may loan pre-official certification very quickly.

And you will need to use a similar warning into the rating on the internet financing products that you would use whenever using face to face. There are lots of important financial security items to contemplate just before your incorporate on the internet for a loan:

Yet not, you’ll be able to still need to provide the exact same detail by detail monetary information so you’re able to an online lender one a stone-and-mortar lender would want

- Limit the quantity of applications you create. It’s not hard to complete programs and you may submit them with brand new mouse click out-of an effective mouse. But know that unnecessary applications from inside the a brief period of time may harm your credit rating. Regrettably, you are able to seldom rating a performance estimate unless you submit an application, but alternatively out-of seeing this new costs decrease, you can even see them increase after you’ve recorded loan requests to several lenders.

- Be cautious about lure and you can key now offers. Because it can happen face-to-face, you might be offered an excellent low interest online, just to understand the low rate fall off in advance of you are going in order to closure. While you can get qualify for finest terms someplace else, the fresh new cyber-lender is betting you don’t have time to look, pertain and get acknowledged prior to their closure time. Make sure that your on the web rate was secured in the, similar to might whenever referring to a loan provider face-to-deal with.

- Definitely discover where your financial research goes. On the web fraud will get more innovative everyday and it’s really not difficult to possess people to create glamorous, professional-looking websites. Do not be conned of the also offers away from unbelievably low pricing off unknown loan providers. Identity theft most goes an internet-based credit usually makes it simple. For folks who submit a loan application but do not located a response, so what can you are doing? Before you transmit your own social safety amount, lender and you may credit membership amounts and other information that is personal online, verify the fresh lender was real.

What exactly is predatory credit?

Predatory financing try unfair, deceptive and you will/otherwise deceptive financing. The best aim try individuals who aren’t advised and people that do perhaps not check around to have financing rates and you can terms and conditions. If you are females, seniors and you will minorities are affected from inside the better quantity, you can now get to be the sufferer out of predatory loans.

The new You.S. Institution off Houses and you can Metropolitan Advancement keeps understood specific sexy locations in many towns and cities where predatory lending might almost epidemic. Verify if you live close that.

How can you include oneself from predatory credit? Basic, remember that it exists. Take time to look at the home section of your neighborhood newspaper otherwise search online to see exactly what interest levels regional lenders are recharging. If you find yourself considering that loan, query in the event the financing words being offered are the most effective terms and conditions where you qualify. First of all, discover ways to acknowledge predatory credit techniques.