Education loan debt is actually synchronised with homeownership, however, that it matchmaking isnt stable across the lives cycle

IV. Estimation

Within part we introduce our very own conclusions. Basic, during the point IV.An i define some elementary correlations between education loan loans and you will homeownership, plus just how these types of evolve along side lifetime cycle and you will differ because of the degree height. In the part IV.B we inform you the outcome of numerous regressions, trying to target the fresh endogeneity out of student loan personal debt from the managing for observable properties. The chief character approach, playing with an important varying means and also the medication/control category shaping, is actually detailed for the point IV.C. We then present the outcomes in point IV.D. Inside the areas IV.Age and you can IV.F we talk about possible disappointments your identifying presumptions and you can manage a number of tests so you can confirm them. Ultimately, inside the section IV.Grams i imagine the result out-of college loans to your individuals’ borrowing from the bank results and unpaid standing as well as the sized their mortgage stability.

A good. Models regarding Obligations and Homeownership

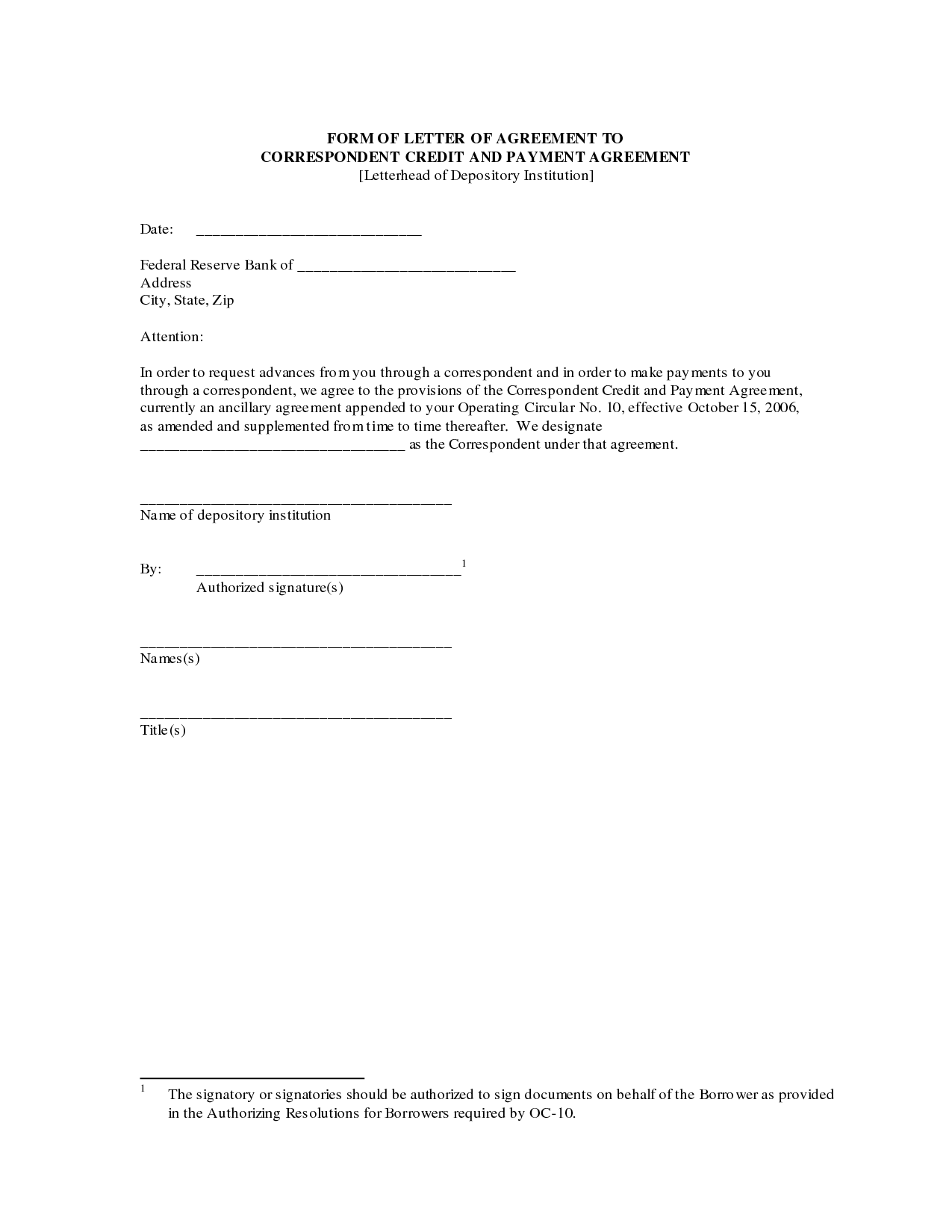

Contour step one plots of land the probability of ever which have taken on a good mortgage contrary to the individual’s ages for various amounts of student obligations. In profile 1A, i contrast people that attended college or university before ages 23 in the place of providing toward obligations having those who performed borrow as well as that have those who don’t attend university of the you to definitely age. Debt-free school attendees have a top homeownership rate than just its with debt co-worker from the decades twenty two, but people with debt connect and you may exceed the debt-100 % free category by years 31. Inside shape 1B, i improve college attendees towards the around three groups considering loan amount: no borrowing from the bank, below $fifteen,000, and most $fifteen,100. Pupils who obtain modest number start less inclined to very own than nonborrowers but sooner or later get caught up. Individuals who lent one particular start by a minimal homeownership speed within decades twenty-two but they are substantially more likely to be residents of the decades 32 (the new average period of earliest home buying, according to Federal Relationship out-of Realtors). From these plots one to would be inclined to finish you to, about from the typical work on, higher education loan loans leads to a high homeownership price. Fig. 1.

Homeownership rate by years, debt level, and studies. College or university attendance and you will degree achieved are outlined based on if men and women have went to college and you can acquired a qualification, respectively, prior to years 23. Education loan debt quantity mirror the level of government student education loans disbursed before decades 23. Homeownership speed in the a given years is described as actually that have drawn a home loan because of the one to ages.

Determining just how education loan loans influences homeownership isnt thus simple, although not. People who have different levels of student loan obligations also can disagree in other extremely important indicates. Somewhat, they may keeps different amounts of degree, which is in itself extremely synchronised having homeownership (perhaps courtesy an impact on money). Figure 1C limitations the new test to prospects just who achieved a good bachelor’s education in advance of ages 23. In this classification, men and women in the place of education loan financial obligation have a high homeownership rate than just borrowersparing the bottom one or two boards, students who lent over $fifteen,000 had the large homeownership price one of many general university-going society shortly after age twenty-seven but have a decreased rate among the latest subset that have an excellent bachelor’s degree after all many years. Bachelor’s education users with no education loan debt feel the highest homeownership rate over https://paydayloansconnecticut.com/blue-hills/ the variety of age. As a result, simple correlations certainly dont grab the entire visualize.

B. Options on Observables

After that activities that are coordinated with both education loan financial obligation and you may homeownership (and can even become driving the new noticed matchmaking ranging from these two variables from no. 1 attention) are the form of college attended, selection of major, and you will local economic conditions, for example. One possible personality strategy is to try to consume every one of these potential confounders which have a comprehensive gang of handle parameters. With regards to evaluation with this important variable estimates (exhibited during the sec. IV.D), i work with age-certain regressions out of a sign to own homeownership toward student loan expense and other categories of controls using an excellent probit design. On these and you will further regressions, the person-height explanatory variables (also college loans disbursed) are all mentioned at the conclusion of the individual’s 22nd season. The important problems is actually clustered during the household county peak.