First off, end up being aggressive throughout the paying off your debts, specifically mastercard balance

This will be challenging to help you pair with people deals desires your provides. However, while the cost can come off afterwards this present year anyhow, you have got a while so you’re able to balance both debt fees and you can preserving.

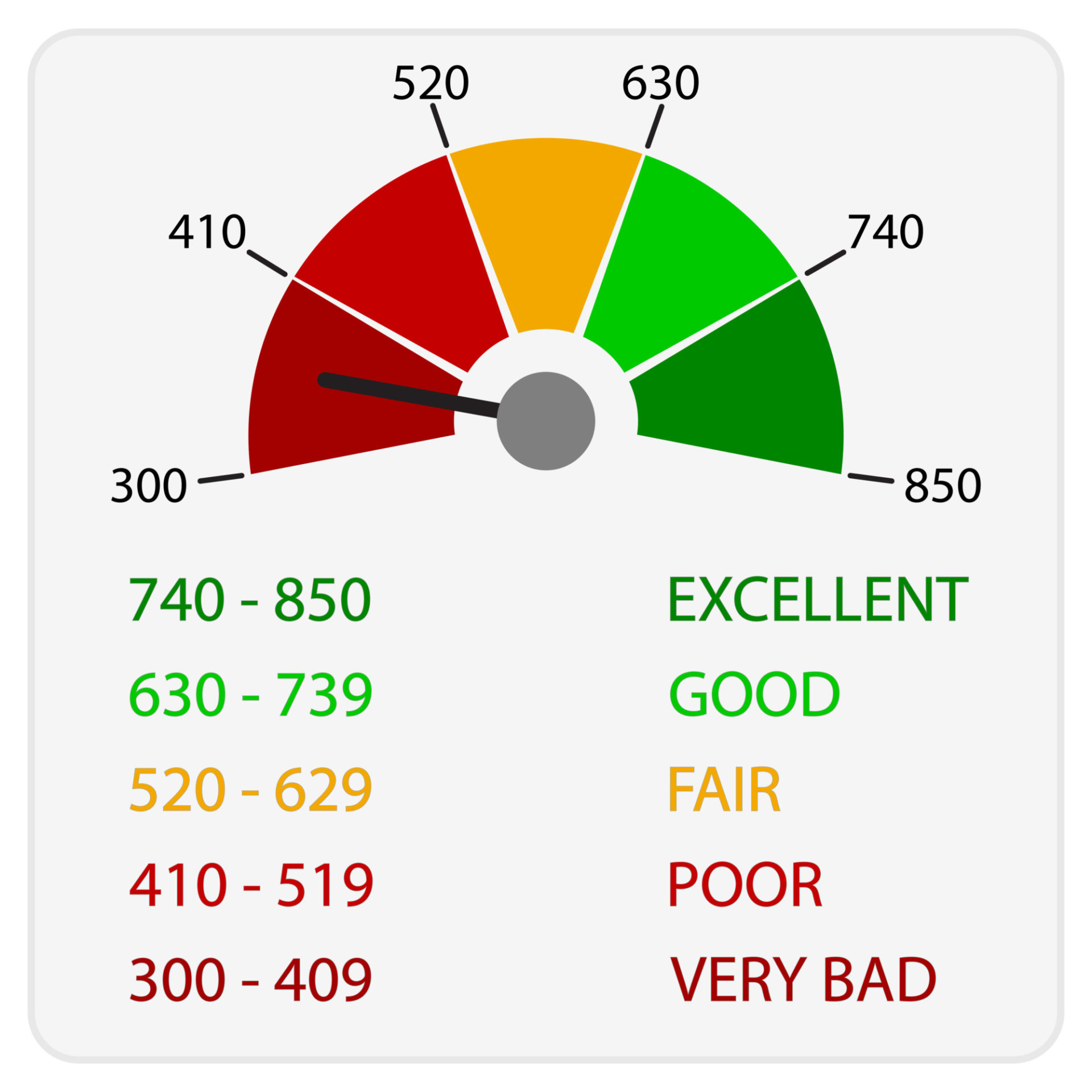

To locate told about how lenders will perceive your, look at the credit rating. You might be legitimately entitled to a no cost credit file regarding all of the 3 credit reporting agencies one time per year.

It is a tedious task, but it can be helpful to undergo one to report line by-line. If you discover any mistakes-particularly an expenses revealing because outstanding after you understand you paid down it-you can disagreement it. Immediately following it becomes fixed, it has to give your credit rating an enhance.

#3: Wait and also make Transform

- Stay in your task. Loan providers want to see uniform employment history. Thus giving the brand new borrower having a stable income they are able to use to make their home loan repayments. Anytime you’ve been considering a career disperse, delay up until when you get.

- Never undertake the newest financial obligation. Applying for people brand new borrowing-if or not that is an auto loan otherwise a charge card-factors a plunge on your credit rating. That is because the possibility borrowing issuer checks your credit score as part of you to definitely software techniques. And that difficult credit check drops products from your rating. Should you want to get the very best financial price, you desire the get becoming of up to possible. For the moment, stop undertaking whatever would require a credit assessment.

- Keep dated credit lines unlock. Credit agencies basis age your lines of credit into the your credit score. Earlier borrowing from the bank form you have sensibly addressed that money for longer, which helps you to increase get. As well as, which have much more borrowing readily available advances your own borrowing usage ratio. You could think counterintuitive, but closing one credit cards will cause the score in order to drop. When you’re ready to apply for a mortgage, continue those credit lines discover. That doesn’t mean you have got to use the credit.

#4: Look into Authoritative Financing Programs

We stated a number of the all over the country applications designed for first-go out homeowners, such as for example Fannie Mae’s HomeReady and Freddie Mac’s Domestic cash loans Boaz It is possible to. We and touched towards FHA, Va and you can USDA money, all of these is actually supported by the us government. Beyond that, many says offer homebuyer applications having basic-big date otherwise economically disadvantaged individuals.

Fundamentally, you might have choices available to you outside of the conventional mortgage. Do your homework to spot and this applications you could potentially qualify for. Many of them can help you rating a lower life expectancy mortgage attract price.

#5: Comparison shop

For folks who merely adhere to that tip on it list, allow it to be this one. This is basically the best method to make certain you’ll get a great competitive interest rate in your home loan.

Consult a speeds quote of a small number of loan providers. According to what they give, get mortgage preapproval having at the very least around three.

Should you get a loan Guess back off for each bank, pick the fresh annual percentage rate (APR). So it means the fresh yearly price of the loan, in addition to not only the pace but one charge on lenderparing APRs across the around three lenders enables you to select and that loan will surely function as the cheapest for you.

Yes, applying for preapproval with many lenders means additional work. But when you need some added bonus to relax and play it, a relatively previous learn from Freddie Mac will help. It found that homebuyers which opposed mortgages off merely a couple of lenders spared normally $600 a year. Consumers whom had four or even more price prices protected more than $step one,200 a-year.