Good borrower’s guide to financing-to-worth proportion (LTV)

Whether you are a first-go out buyer otherwise a citizen seeking refinance, there’s a lot to adopt in the a mortgage app. You to definitely essential requirement is when far your lender is happy to loan your on the the price of the home. Into the choosing that it figure, household loan providers focus on numerous metrics, one of that’s the loan-to-worth proportion, otherwise LTV.

Loan-to-worthy of ratio (LTV): The goals as well as how it functions

Loan-to-worthy of proportion (LTV) was a number, indicated because a percentage, you to definitely measures up how big is the mortgage to your down away from the cost otherwise appraised property value the house or property. For example, a loan away from $150,000 into a property appraised in the $200,000 stands for 75% of one’s home’s well worth. In this instance, this new LTV ratio is 75%.

LTV is a vital profile as it facilitate their financial assess exposure. Regarding the lender’s perspective, more currency they give, more it stand-to get rid of in the event of a home loan default. Usually, the greater equity this new borrower provides when you look at the a property, the low the risk of a standard.

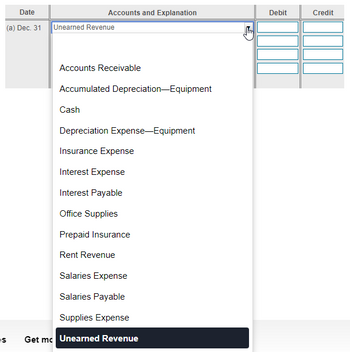

Simple tips to determine LTV

Figuring a loan-to-worth proportion is relatively simple. Just split the mortgage amount of the both the cost otherwise appraised property value the house or property (any is gloomier), right after which proliferate from the 100 to the payment. Like in our example more than, that loan out-of $150,000 separated from the an appraised worth of $2 hundred,000 offers a keen LTV proportion out of 75%.

Note that when the lender works out LTV, they generally look at the developed purchase price regarding a property, not the latest selling price noted from the supplier. The brand new appraisal try ordered of the home loan company but taken care of by the prospective borrower.

Do you want an aggressive LTV?

Financing-to-worth proportion away from 80% or less than can provide you use of alot more competitive mortgage notice pricing. In the event your LTV are greater than 80%, you will be requested to buy private financial insurance coverage, otherwise PMI. This really is an extra insurance policies protecting the lender about chance from standard or foreclosure towards financing.

Prior to entering into a purchase contract, taking prequalified makes it possible to decide how far you are capable establish and you will exactly what property value assets would help make you your ultimate goal LTV. When you find yourself in the course of and make a deal, you might also think raising the size of your own down payment, when possible. An alternative choice should be to keep negotiating for a lesser purchase price or shopping around to have a less costly property if you are not seriously interested in purchasing the latest property.

Naturally, your LTV isn’t the merely foundation a loan provider considers whenever assessing your own financial software. They together with generally speaking need factual statements about your own borrowing, discounts or any other property. Notably, theyll constantly feedback your debt-to-earnings ratio, which is the complete of your own monthly obligations money separated by the the disgusting monthly money.

LTV and you can refinancing

When refinancing, your LTV depends to your latest prominent equilibrium and you can the modern worth of your residence. State your to start with borrowed $160,000 facing a property you purchased to own $2 hundred,000. That actually works out at the an LTV off 80%. Since you pay your own financial (and dominating), your LTV starts to down. This can be currently very good news towards homeowner. However the impression of one’s normal mortgage repayments is not necessarily the merely basis during the enjoy right here. Refinancing usually means an effective reappraisal of your home and it’s really you can easily that your home’s appraised well worth has changed since the lifetime of your purchase.

Just like the a resident, increased appraised really worth is likely to operate in their choose, increasing your house collateral and reducing your LTV. For example, in the event the home is now appraised on $250,000 weighed against the new valuation from $2 hundred,000, you to definitely next lowers your own LTV. By comparison, in the event the residence’s appraised really worth has actually dropped once the lifetime of your own amazing pick, this would push-up the LTV.

https://paydayloanalabama.com/robertsdale/

What’s joint LTV (CLTV)?

CLTV, or combined loan-to-really worth, is yet another acronym you could hearbined mortgage-to-value try determined same as LTV but combines all mortgage balance for everyone liens into the assets – liens such second mortgages, house collateral loans or family credit lines – and not the first financial. Measuring by the CLTV does improve financing-to-worthy of proportion, depending on if you have borrowed facing your property.

Bottom line

Loan-to-well worth ratio (LTV) is an important factor that lenders envision when determining your financial app. Ideal understanding how LTV performs you will definitely show useful in your residence control travel. Whether you are to acquire otherwise refinancing, LTV is the one metric, among others, that can help mortgage business determine how much they are happy to lend.