Greatest Finance Towards Unemployed During the Singapore 2024

In the event Singapore’s jobless speed is actually declining because established has just of the Minister regarding Manpower inside the , you can still find we who are nevertheless out out of operate. If you are out of work, often providing a personal bank loan may help fulfill their emergency need such as for instance unforeseen medical bills due to unforeseen situations, auto solutions, otherwise a financial misstep.

Although not, you will find some considerations to adopt earliest before getting an effective mortgage while you’re underemployed, even as we will not want due currency to an unreliable financing seller which can bring about high liabilities. Ergo, we’ve got shortlisted particular known and you can safer personal loans inside Singapore to own the fresh new unemployed, for the quickest approval and money disbursement.

The way to get An easy Unsecured loan If the I’m Out of work When you look at the Singapore

There are a variety from finance toward out of work provided by licensed moneylenders, no matter if far lesser as opposed to those being accessible to working individuals. Listed below are some a method to reduce your mortgage approval date otherwise rating a balance transfer while you are underemployed, and increase your odds of obtaining funds on your account as quickly as possible.

Have a good credit score

Keeping a good credit score will help you to rating an individual mortgage much faster which have shorter approval lifetime of your finance by signed up moneylenders. Your credit score is sometimes determined by specific points together with late money, the degree of borrowing from the bank you utilize, dependent credit rating, recent borrowing from the bank, and also the quantity of accounts you hold.

Individual way too much possessions

After you individual possessions particularly an excellent HDB flat, individual and you can/otherwise arrived assets, a vehicle otherwise enjoys security inside the a home, your application to have a personal loan could have an elevated opportunity of being acknowledged even after becoming out of work. This is because the mortgage provider are able to use that it since the safety into loan.

Envision a joint app

When you are unemployed, you can try applying that have another person, such as your wife or husband if you don’t a pal whom was attracting a routine income possesses a good credit score, to boost the eligibility for the finance you are applying for because an out of work person. That is considered a joining software as well as the guarantor or cosigner (who is your wife/husband/relative/friend) shares the responsibility out of paying off the mortgage.

Look for finance with easy money disbursement

Making certain to check the cash disbursement lead date is important when you require a simple loan. In the case you really have SingPass MyInfo account and financing supplier you select offers the accessibility to applying with your Singpass MyInfo info, just be able to find the money faster while the the loan software go out are shortened (according to types of licensed moneylender in addition to their words and you can conditions), but when you have to would a separate membership, that might just take a longer time.

Essential things To remember Before you apply For a loan

Whenever you create a different sort of application for the loan to a licensed mortgage seller otherwise bank, they will certainly retrieve your credit history from your details hence enquiry was placed on your own file.

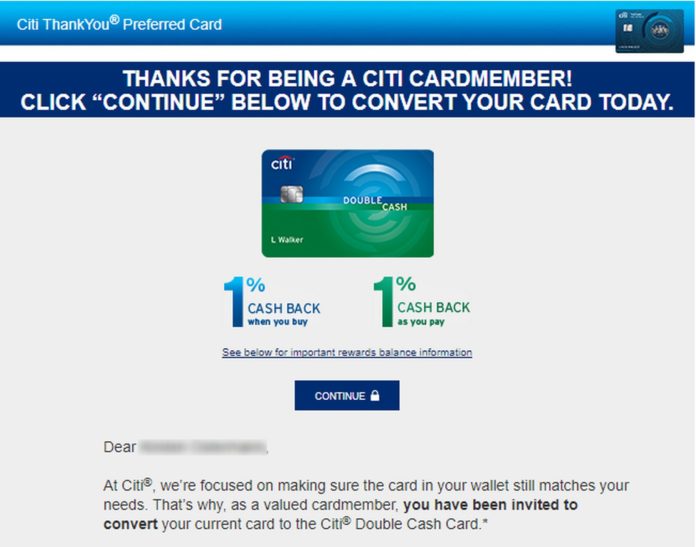

It can usually be simpler and you will reduced to try to get a good personal bank loan out of your current charge card giving bank because they currently have your info. Although not, if you don’t have any income otherwise handmade cards on when, will still be far better only choose one otherwise a couple.

Converting brand new vacant borrowing limit in your charge card (when you are making an application for financing with your credit payday loans Somerset card issuer) can shorten this new recognition time of the loan request just like the lender already accepted just how much these were prepared to provide you once you signed up for the new card, so there wouldn’t be a unique bullet of document operating and you will recognition. Try to keep your own balances reasonable (ideally lower than 30% of one’s maximum) also once the using excessive readily available borrowing from the bank is damage your borrowing rating.

Interest rates are not the only factors to look out for, you should be cautious about most other costs particularly running fees, prepayment fees and you may late commission charge and read the latest small print carefully. Remember to ask toward complete revelation of all of the loan terms and conditions, and examine within some other subscribed creditors.

An equilibrium transfer try an alternative choice to taking a personal once the it is a primary-identity dollars facility who has 0% interest, which is generally borrowing from the bank on the readily available borrowing limit of your established line of credit or charge card account. Also, it’s got versatile repayments more than a short span of time. not, discover a one-go out operating payment which you can have to pay along with to repay what you owe in this step 3 to 18 months.