Household Equity Financing Interest rates Are Reasonable

Domestic collateral fund usually are high finance, and process to get you’re much like the one to your implemented after you grabbed your buy mortgage. Ergo, they have been top set aside to possess biggest, one-time expenses you simply can’t defense if not – or for personal debt that can charge you so much more to bring over time than simply property collateral mortgage will. Here are some preferred causes home owners utilize them:

Renovations

Detailed restorations otherwise large house repairs will be expensive, a lot of people decide to remove a property guarantee mortgage to pay for such costs. Enhancing the property value your house is not the only justification while making advancements, however, if it’s an essential choice for you, know that the newest selling worth of very home improvements was reduced than simply their costs. Possible only recoup regarding the 60% of one’s cost of an average toilet renovate, eg, based on Restorations magazine’s 2021 Cost vs. Really worth Declaration.

Consolidate Debt

As the interest to your property collateral financing is significantly lower than to own handmade cards or any other loans, many people use the household guarantee mortgage in order to consolidate and you will pay away from earlier in the day bills because can help to save him or her cash on notice can cost you. This may, consequently, make it easier to pay back the money you owe much sooner.

Pay money for Studies

It’s no miracle you to studies is expensive, specifically higher education. The common cost of tuition and fees getting students so you can sit-in a several-seasons college for one 12 months selections off $ten,338 to have an in-county public-school in order to more than $38,185 to possess a private college or university, centered on U https://paydayloancolorado.net/hudson/.S. Development & Globe Declaration. Proliferate you to figure by the four years, and total training costs can merely come to more than $100,100000 for starters beginner.

The eye towards a property equity financing isn’t really always lower than the interest towards a studies financing. Get a hold of, such, prices annual percentage costs between cuatro.15% to help you % for second financial. In comparison, individuals pay cuatro.45% otherwise seven%, respectively, to possess government Stafford and you may And financing. However, family guarantee funds keeps a benefit those people financing cannot – much higher constraints, if you have sufficient equity.

Scientific Expenditures

A house security loan will keep you from being required to lose your overall health from the highest price of managing a disastrous illness or burns. You should be conscious that you want a steady earnings in order to qualify to your loan, of course your problems or healing renders you unable to remain and make your payments, you can clean out your home.

Benefits of Domestic Security Loans

If you’re considering a house equity mortgage, weighing the pros and you may downsides facing additional options to choose in the event that it is the best way so you can acquire to suit your disease. Check out of perks of domestic guarantee financing:

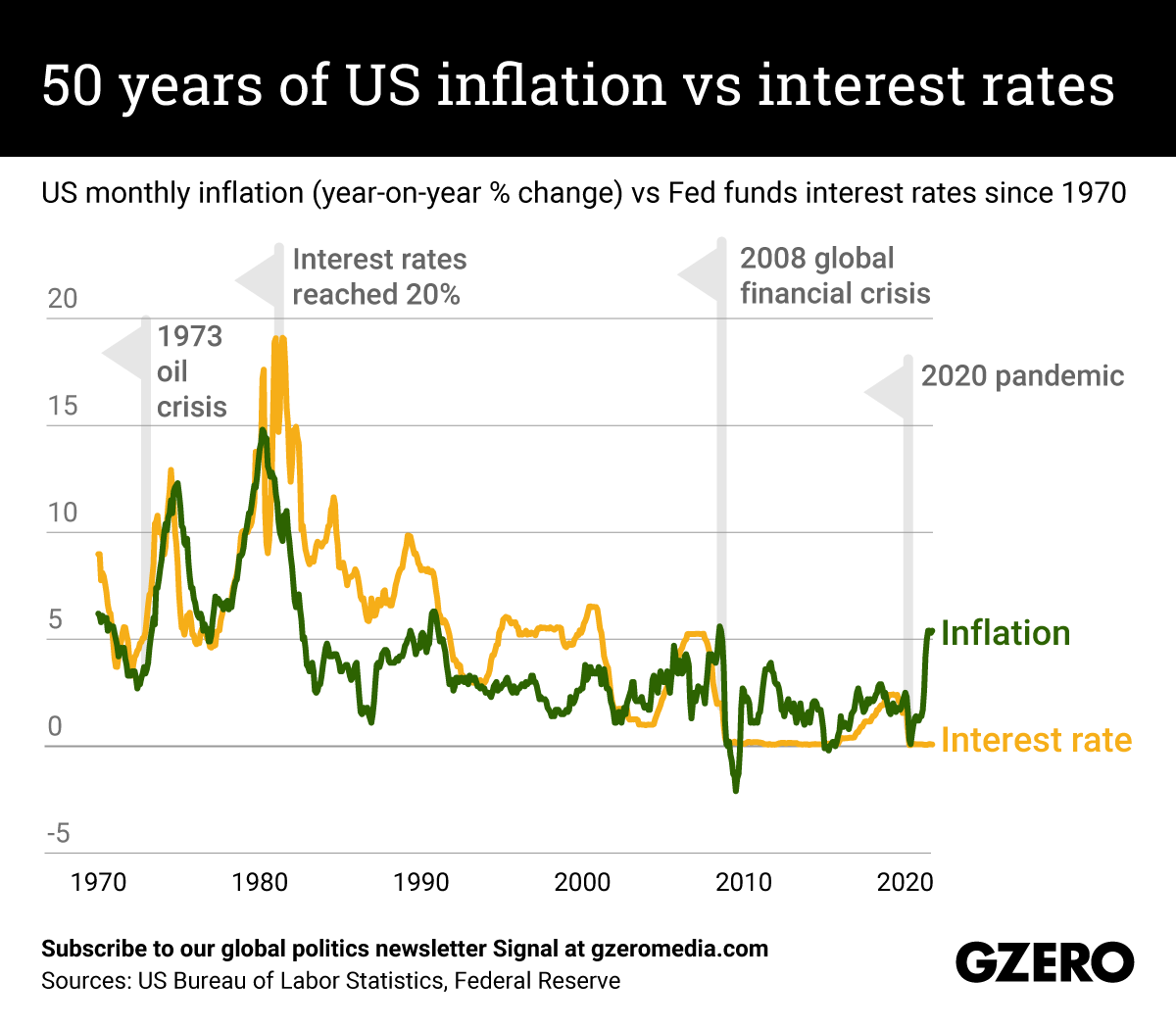

Since the chance getting a lender is lower – due to the fact fees of one’s loan try secured from security out-of your house – rates are usually less than those of signature loans.

Repaired Costs

Unlike credit cards, which include varying APRs, domestic security loans often have fixed interest rates, and that convert so you can fixed monthly installments.

Is generally Tax-Deductible

Your property equity mortgage is actually income tax-deductible providing you put it to use to buy, generate or considerably improve household you borrow on. you possess write-offs other than attract towards the issues use the loan having – eligible knowledge or medical expenses, eg.

Drawbacks out-of House Collateral Finance

Though home collateral money may appear such a sweet bargain if you are in need of a huge amount of money, you will find some what you should be cautious about:

Will cost you and you can Charges

Home collateral loans typically have closing costs one to total dos% to 5% of your loan amount. The costs you will are application and you will origination charges, label costs, document preparation and submitting, plus the appraisal your own lender often acquisition to confirm the property’s market price.