Lender away from The united states Home loans is the home loan product out of Financial off The usa

During the 2008, Financial out of The united states purchased the fresh a deep failing Nationwide Monetary for $cuatro.1 million. In 2006, Countrywide funded 20% of all mortgages in america, from the a property value in the step three.5% of the Us GDP, a proportion more than another solitary lending company.

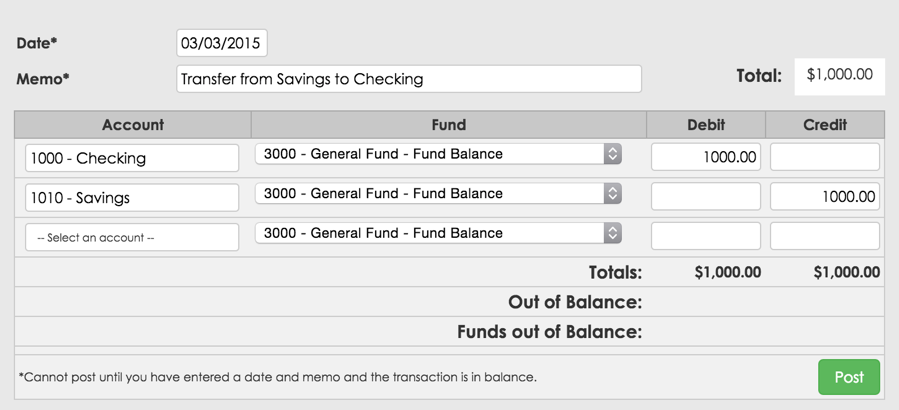

Financing repair qualities financing, we

Countrywide is depending in 1969 from the David S. Loeb and you can Angelo Mozilo. Loeb passed away in 2003. The initial public providing is actually lower than winning, with business trading and investing over the counter from the less than $step 1 for every show. For the 1985 Nationwide inventory is actually re-on the Ny Stock-exchange underneath the ticker symbol CFC.

Countrywide’s inventory could have been known as the brand new “23,000% stock” by Luck magazine. Anywhere between 1982 and you may 2003, Nationwide put people an effective 23,000.0% go back, surpassing the brand new returns out-of Washington Common, Walmart, and Warren Buffett’s Berkshire Hathaway.

All these money are acquired making use of their home loan financial subsidiary, Nationwide Home loans

On erica launched which wanted to pick Nationwide Financial for $cuatro.step 1 billion into the stock. Towards erica Agency revealed it had received acceptance regarding Panel of Governors of your own Government Put aside System purchasing Nationwide Economic Firm. Following, toward , Nationwide announced it had been administered the new acceptance off 69% of its investors into organized merger which have Lender regarding The united states. Finally, to the erica Organization done its acquisition of Nationwide Financial Company.In 1997, Countrywide spun out-of Nationwide Mortgage Financial support given that a different providers entitled IndyMac Bank. Government government seized IndyMac with the , immediately after a week-much time financial manage.

The loan Banking section supplies mortgage loans through some avenues to your a nationwide level. Many of the loan funds the firm provides within this section are offered on additional , 45% ones mortgages was in fact antique low-conforming money, finance too-big to sell in order to Federal national mortgage association.The business basically work the ongoing upkeep services about the new mortgages this produces. What’s more, it provides certain financing closing properties, such as for example term, escrow, and you can appraisal.

This new part away from Loan Design is to try to originate and you may money the fresh new funds and to and obtain currently-funded financing as a result of commands off their loan providers. Financing Manufacturing provides mortgages by way of five divisions away from Countrywide Home Loans: Individual Places, Full Range Lending, Wholesale Financing, and you will Correspondent Lending.

User Segments and you will Full Range Lending bring funds right to customers. Delaware payday loans Financing created by these two retail divisions is originated, financed, and you will offered of the Countrywide. Consumer Avenues also offers various factors, while Complete Spectrum Lending focuses on circumstances befitting consumers that have below primary-high quality borrowing.

Correspondent Lending purchases mortgages from other lenders, including financial bankers, industrial banking companies, deals and financing relationships, family designers, and credit unions. These financing tends to be sold of the Countrywide to finish-traders into the supplementary markets but they are began and financed because of the other loan providers.

e., gather repayments on debtor, covers escrow levels, tax and you will insurance coverage payments (in the event that applicable), upcoming remit “advances” for the investor’s trustee since the specified about Pooling and you will Servicing Arrangement (PSA).

New Financial segment contained Nationwide Bank, FSB, and you can Nationwide Warehouse Credit. Formerly, the lending company are known as Countrywide Financial, Letter.An effective.. Which in the united states chartered financial is actually regulated as one from the Workplace out of the fresh new Comptroller of your Money and the Government Put aside. However, they translated their constitution to a beneficial federally chartered thrift that is regulated because of the Office away from Thrift Oversight. Countrywide Lender ‘s the 3rd biggest Discounts and you may Mortgage business and you will is the quickest-increasing bank within the All of us history. Property out-of deposits are currently dealing with $125 mil.

Countrywide Bank generally develop and you may instructions mortgage loans and you can house equity credit lines to own capital intentions. On the other hand, the financial institution get retail deposits, mostly licenses from put, through the internet, telephone call locations, and most 2 hundred monetary stores, some of which had been based in Countrywide House Loans’ retail part workplaces as of .