Might you Score home financing With no Credit rating?

Article Note: The content regarding the post lies in the new author’s opinions and you may suggestions by yourself. It may not was indeed examined, commissioned or else endorsed because of the any kind of our circle couples.

Obtaining a different financial are going to be an intimidating processes, especially if you enjoys a reduced-than-most useful credit rating. While you are looking to pick a home in place of a credit score at all, even if, you will probably find the method as significantly more problematic.

When you are there are particular loan applications and you will loan providers having minimal borrowing from the bank rating requirements, there are methods based on how to leave a home loan that have no credit score. Here is a review of what to expect regarding process and you may your options you’ll have.

- The way to get home financing and no credit history

- Mortgage programs that allow to possess home loan approval without credit score

- How to show their borrowing in place of a credit history

- How lenders be certain that nontraditional borrowing from the bank records

- Preciselywhat are specific explanations you might not has a credit history?

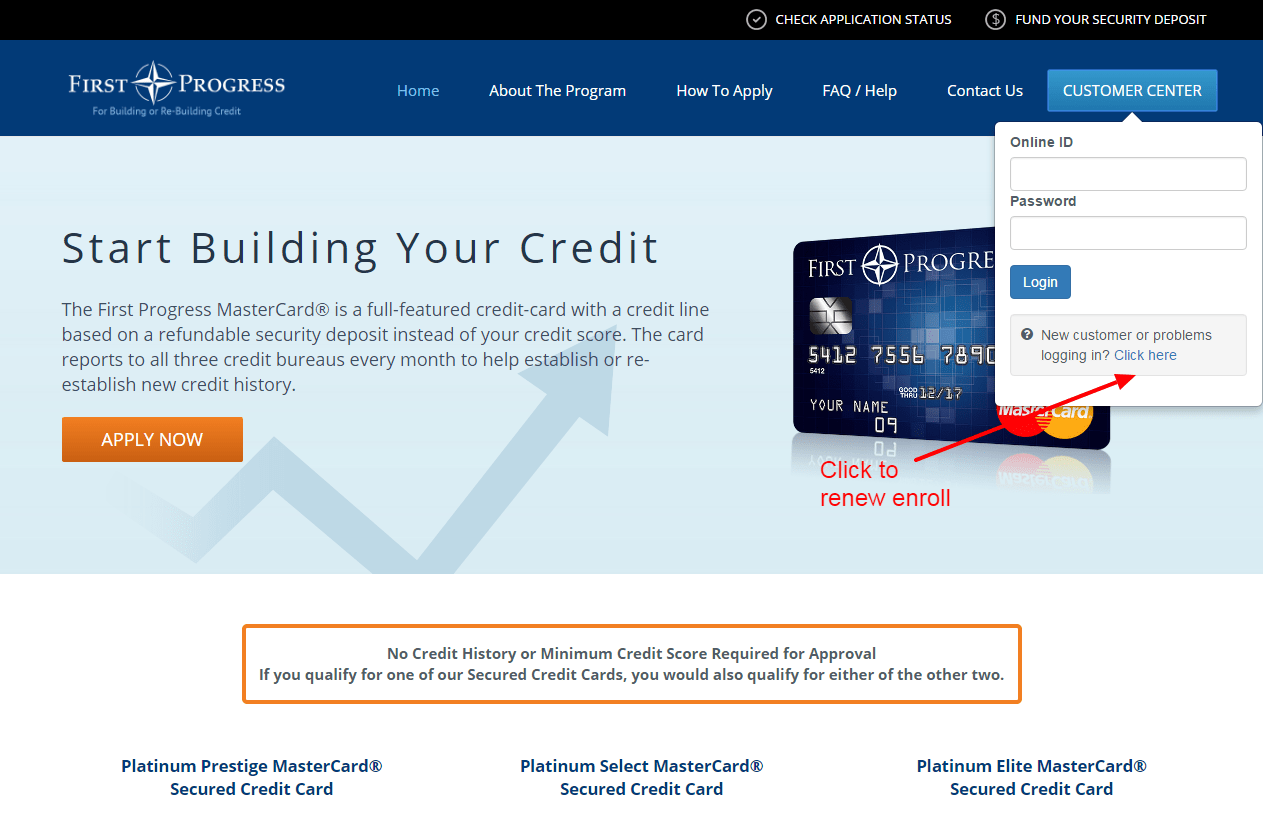

- How to get credit

Ways to get a home loan without credit score

There are a few specific things you certainly can do if you’re hoping to get a home loan with no credit history. Here are some ideas away from the place to start.

Get an excellent cosigner

Whether or not you have less than perfect credit or no credit rating whatsoever, adding an excellent creditworthy cosigner to the real estate loan are going to be one treatment for change your approval potential.

A good cosigner is actually a person who agrees to fairly share obligation to suit your financing and its fast repayment – even when you might be one officially making costs every month. Your cosigner are a partner, parent, sister if not a close friend who’s willing to be added to your own home loan. It is very important keep in mind that your loan and its payment background is stated on the borrowing, too.

Keeps a giant downpayment

The greater the deposit your render and work out toward a good domestic, the fresh shorter risk the lender has to take into the by providing your a mortgage loan. If you decide to default in your loan cost, the lender have a better danger of recovering their cash if you have already shared a significant portion and you may/otherwise there is certainly popular guarantee created in the home.

If you’re incapable of be eligible for an alternate mortgage loan along with your established credit history, giving an enormous advance payment may help improve your chances. On the other hand, certain lenders and you will real estate loan factors might need a larger down payment if your credit rating is leaner.

Proceed through a handbook underwriting techniques

For the mortgage underwriting procedure, a loan provider analyzes a great borrower’s number of chance in relation to installment of their the fresh new mortgage. It indicates looking at points for example money, a job standing, established financial obligation or any other expenditures to find out if new debtor can be reasonably make monthly installments instead of striving.

Issues Should be aware of

Many lenders now fool around with automatic underwriting possibilities, hence incorporate computer programs so you can first vet real estate loan applicants. However, these assistance are designed to get a hold of warning flag, such as a minimal or nonexistent credit history, and might cause an assertion of your own loan application. By requesting a hands-on underwriting processes – and therefore a person underwriter knowledge the program by themselves – you will be able to stop an automatic assertion. Such underwriters are able to use their unique reasoning during the reviewing your application, considering the things considering https://paydayloansalaska.net/stevens-village/.

Play with credit unions or on the web loan providers

If you have a preexisting connection with a cards relationship otherwise regional financial, you may have a far greater likelihood of mortgage approval there. That is because credit unions usually have way more flexible lending standards and you will an even more customized means. When you have almost every other affairs during that business – for example a car loan otherwise bank card – while having proper commission background towards those membership – the institution has a tendency to take it creditworthiness under consideration.