Only bank card costs are acknowledged through the Eventbrite webpages

The new Arizona Condition CDA is actually a good HUD Approved Homes Service taking Homebuyer Telling, Homebuyer Degree, as well as for those who be eligible for a down payment Guidelines program. Our Homebuyer Informing and Education software are capable of the individuals lookin when deciding to take the home to acquire plunge towards earliest-time, or experienced property owners seeking clean upon the brand new inches and you may outs of the home to get process.

Homebuyer Knowledge

The brand new CDA offers Homebuyer Studies 1 of 2 suggests in person otherwise on the web. Homebuyer Degree is a great follow up so you can Homebuyer Advising appointments. Homebuyer Training is required of the loan providers for most very first-big date homebuyers due to the fact a condition of their mortgage and/otherwise deposit direction system approval. Homebuyer Training empowers homebuyers towards expertise in how process work and you can what to expect when selecting a home.

In-individual, the latest CDA even offers a property Increase Working area, which is 7 instances of homebuyer knowledge available with new CDA on a go now monthly, both since the a nearly all-date 7-hours working area otherwise two-four-hours coaching educated over two day/nights courses. House Offer assists participants comprehend the real estate process and strategies. People are certain to get a certification up on end of your own working area.

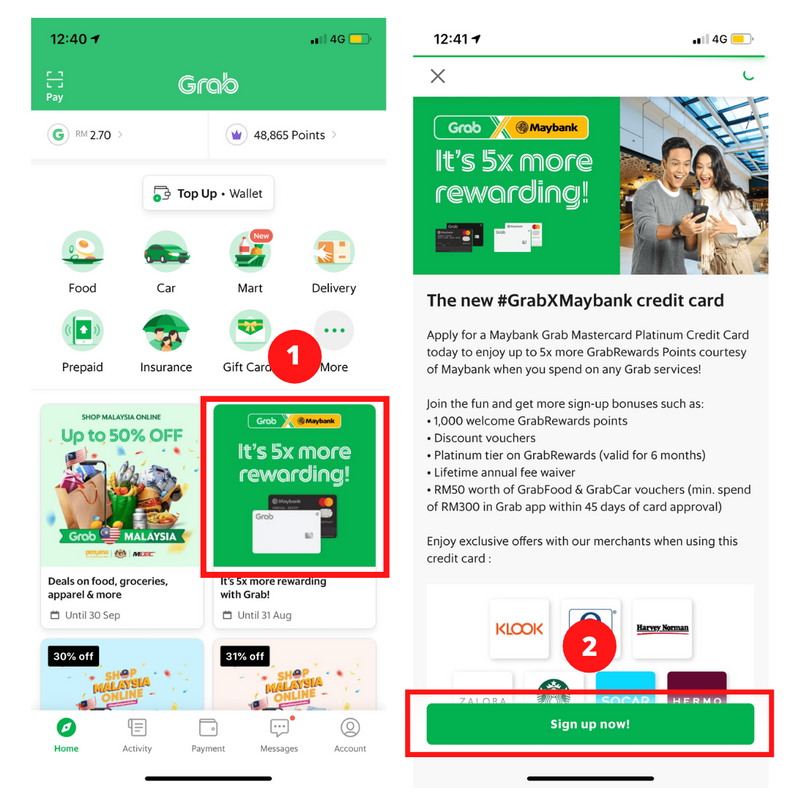

Observe a listing of up coming courses, and/or perhaps to sign up for a seminar online through Eventbrite, excite view here.

Topics covered on a home Expand Workshop were as property owner, home owner currency management, borrowing from the bank criteria, home loan financing and you can finance, agent expectations, domestic inspection review, loan closing and society affairs. Really course keeps top-notch world volunteers (that non-biased and not allowed to highlight to help you members) that can help cover these subjects and provide information about your regional house customer field criteria. The cost is actually $forty. If you would like to blow having bucks or take a look at otherwise request a charge waiver, delight get in touch with your house ownership department on CDA.

You would like even more independency than simply an in-person Household Expand Working area? Design brings an online household visitors studies movement which may be accomplished in the home or away from home on your pc, tablet otherwise your mobile phone. Many people complete the coursework into the 4-six hours. Many exact same topics was covered from the for the-person workshops as in the web course. Advice offered through Framework is dependant on federal investigation, so you could want to talk with a beneficial homeownership pro to possess a totally free Homebuyer Advising meeting to find out the way the pick processes pertains to you. The cost of Structure are $75 view here to find out more or to register! (brand new CDA ework)

To arrange a free Homebuyer Informing fulfilling or demand even more details about any of the applications in the list above, delight make use of the email address below. The audience is HUD-approved homes guidance department. Most of the Advising, and you can Knowledge system properties is actually confidential.

Homebuyer Advising

The fresh new CDA also offers Free Homebuyer Telling. Many individuals features questions relating to to invest in a property. Simply how much must i afford? Exactly what credit history manage I would like? What is Case, PITI, otherwise PMI? Our homeowner specialists makes it possible to get going on the right direction.

When you look at the meeting, the latest resident pro often remove your credit score free of charge and you may review they to you and if needed, provide the devices to wash it up and you will replace your credit ratings. The new resident professional often remark additional mortgage applications and you will any local or state down-payment/settlement costs guidelines applications that you may possibly be eligible for. They’ll make it easier to figure out what you really can afford, how exactly to cover your new household and construct a post fulfilling action plan and therefore info the steps needed to see debt needs.

Excite address the questions and you may indication the new disclosures because provided on line. While the consumption mode are gotten, people tend to contact you to establish a scheduled appointment to talk regarding the state and you may give you advice of every more information otherwise files that could be necessary. If you need assist completing the design, you might phone call brand new homeownership people within 651-202-2822 or elizabeth-mail [email secure] for guidance.

Looking for information about homebuyer guidance?

Give us a call in the , otherwise send us a message making use of the get in touch with switch less than. A member of our homeownership employees will be in touch with your soon to resolve any queries while having the suggestions you prefer.