step 1. Ideal for Individualized Services: CrossCountry Financial

With regards to financial items, USDA loans should be a nice-looking option. These loans have numerous masters, as well as lower rates of interest no deposit criteria. To discover the most out of a great USDA loan, it is critical to find the appropriate USDA lenders. Suitable financial can save you currency and then make the fresh new procedure of purchasing your 2nd household as simple to.

Glance: Greatest USDA Mortgage brokers

- Good for Custom Provider:CrossCountry Financial

- Good for Educational Resources:PNC Bank

- Good for Evaluating Selection:Legitimate Mortgage

- Perfect for Military Family:Veterans United

- Good for Customer care:The new Western Investment

- Quick look: Better USDA Mortgage brokers

- 5 Most readily useful USDA Mortgage brokers

- step 1 loan places Silver Cliff. Ideal for Personalized Services: CrossCountry Home loan

- See All twenty two Items

5 Most useful USDA Mortgage lenders

USDA mortgages all are, so there are a good amount of lenders to pick from. Remember that for each and every financial need follow the brand new USDA’s requirements to have the borrowed funds and might include extra requirements also, as per their needs.

Cross-country Mortgage was a lender that gives a wide variety of pick and re-finance loans, together with USDA home loans and you can USDA Outlying Streamline Money fund. You could potentially apply for either loan toward CrossCountry Home loan website. The program takes you from measures and you will be considering financing choices and you can individualized cost considering your data. For folks who located preapproval, the company might assist you from closing techniques.

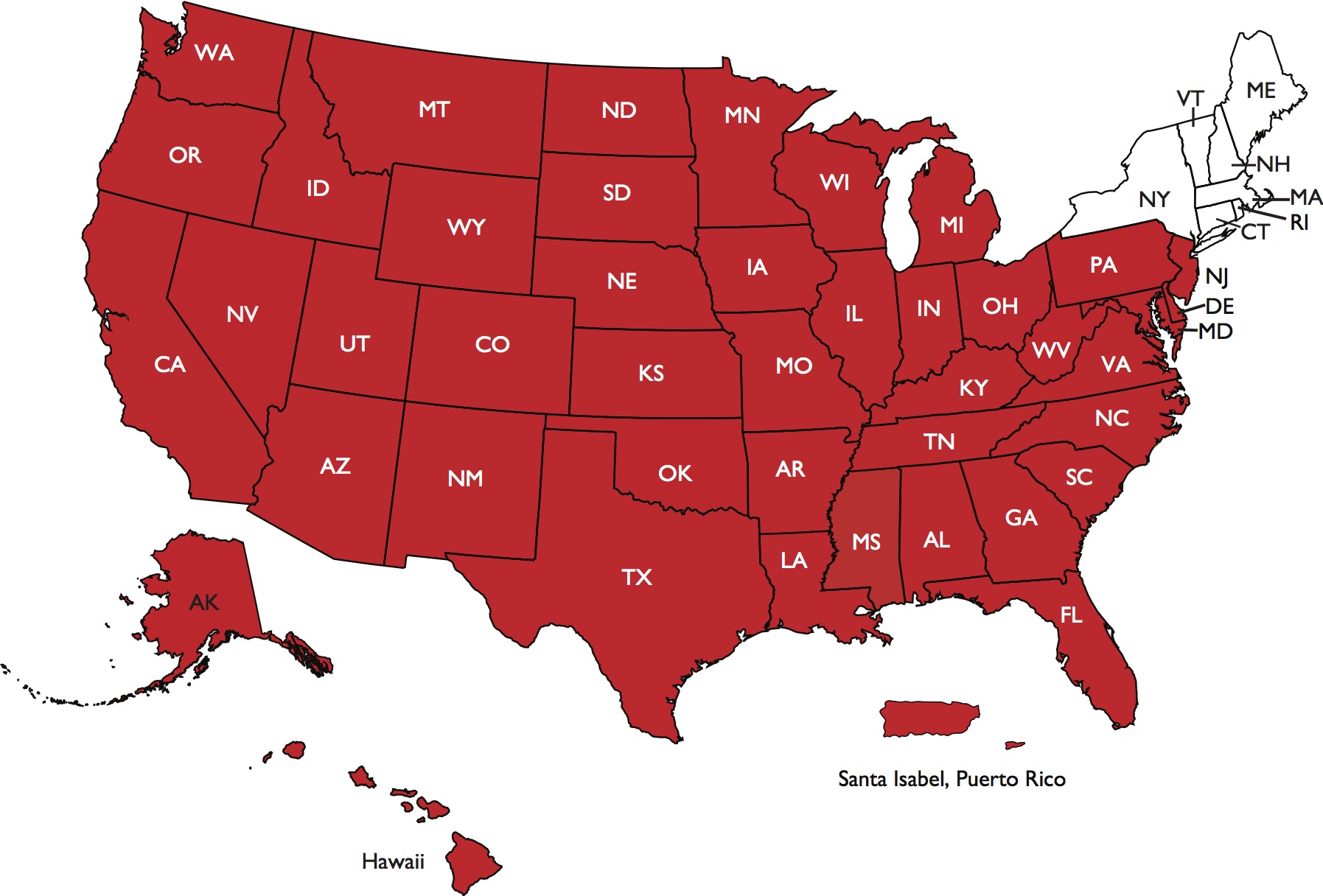

Why we Like it: We love CrossCountry Home loan for the individualized support service and you may loyal loan officials to support for every app. Cross-country Mortgage also operates in all fifty says and also hundreds from branches nationwide, therefore it is an obtainable solution.

dos. Best for Instructional Tips: PNC Financial

PNC Lender is another bank that provides numerous mortgage systems. They mainly targets jumbo loans in addition to offers USDA money or any other financial alternatives for lower-to-moderate-earnings individuals. You can begin the latest preapproval process to own home financing from this financial online otherwise plan a consultation having a mortgage administrator at an out in-people place.

Why we Adore it: PNC’s site offers current interest levels. The lending company has the benefit of on the internet tools, and projected monthly premiums, home financing condition creator and.

step 3. Best for Researching Solutions: Reputable Home loan

Reliable is an individual fund markets that assists borrowers examine financing, also mortgages, college loans and private money. The market industry allows you to speak about fund and just have personalized financing pricing.

The reason we Think its great: We like one to Reputable is a straightforward marketplaces. Its 100% liberated to explore and using the market does not impact your own credit rating. The business along with relates to in itself as the utmost moral marketplace and you can says it cannot sell your computer data.

cuatro. Ideal for Military Group: Veterans United

Experts United are a lender seriously interested in enabling Veterans and you may armed forces group go possession. That it bank mainly has the benefit of Va financing and old-fashioned, FHA and you may USDA money. Veterans United generally means a credit score with a minimum of 620 so you’re able to be eligible for that loan.

Why we Like it: We like Veterans United for the dedication to military parents and you will Experts. The firm also provides simple and fast on the internet prices and you can individualized customers support. Pros Joined keeps a team of Financial Specialist offered 24/seven to respond to questions regarding the money and financing applications.

5. Ideal for Customer service: New Western Resource

The brand new American Capital offers a varied assortment of services competitive rates to any or all of its consumers. Getting USDA finance, the lending company needs the absolute minimum credit rating away from 580. Borrowers can be demand a bid on line to begin with the process.