- Incorporate Value

- Major Renovations

Alesandra Dubin is a lifestyle author and you will content revenue creator created when you look at the Los angeles. This lady straight areas of expertise include a home; travel; health and wellbeing; meetings and incidents; and parenting. The lady work enjoys appeared in Providers Insider, An effective Housekeeping, Today, Elizabeth!, Parents, and a lot of most other retailers. She holds a beneficial master’s studies from inside the news media away from NYU.

In the HomeLight, all of our vision is actually a world in which most of the a residential property exchange was easy, specific, and you will satisfying. Hence, i provide rigorous article ethics in the each of our postings.

In 2020, an average American house invested $8,305 to the home improvements – that’s nearly the specific number the average household enjoys inside their bank account, considering Bankrate’s recent analysis of information throughout the Federal Reserve.

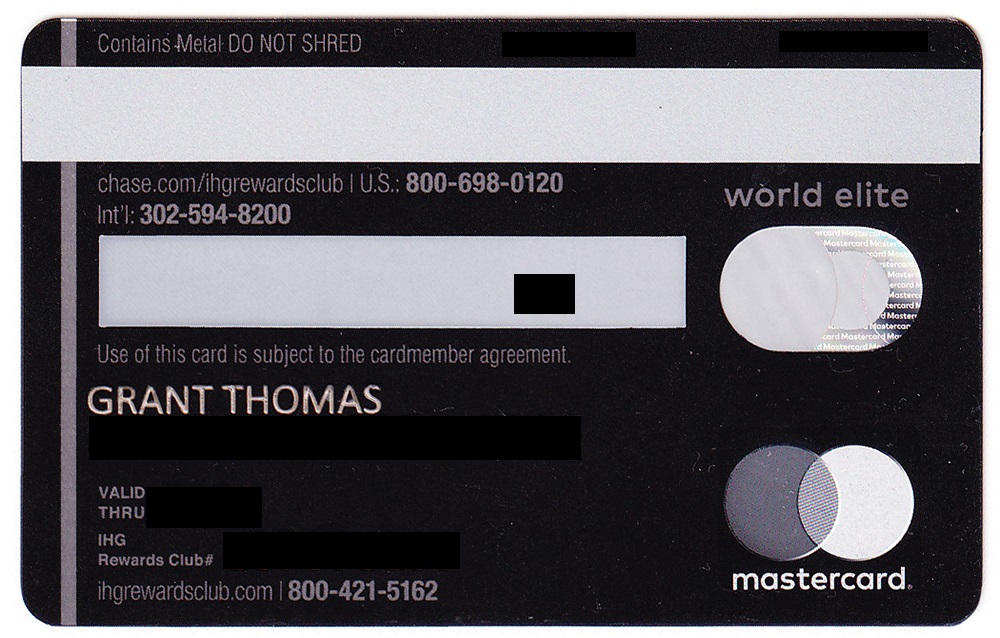

But alternatively than draining the Hamilton payday loan discounts, extremely home owners choose fund their home do it yourself that have credit otherwise property restoration financing. A recently available survey of the Get a hold of Domestic Security Loans indicates that 23% away from residents plan to buy their restoration with a cards card, 18% that have property guarantee credit line (HELOC), 13% having a property guarantee mortgage, and you can eight% having dollars-aside refinance.

If you’re considering taking out a property restoration loan to spice right up a powder room or abdomen your kitchen, we now have you secured. Our very own specialist-recognized primer unpacks the brand new assortment of recovery mortgage solutions today and how it impression your future home selling. We will in addition to display easy methods to work with building work tactics one to add value to your home to help you recover your financial support.

An introduction to home restoration mortgage options

Whenever you are wanting taking out fully a house renovation mortgage, you really have possibilities. Listed here is an overview of the preferred household recovery funds readily available:

Cash-out refinance

Using this choice, brand new debtor refinances their current financial, in addition to lender advances an additional amount inside cash towards the repair endeavor. Usually, lenders enables home owners so you’re able to refinance 80% so you’re able to ninety% of the property’s worth.

You can think of this choice when you yourself have at least 20% security throughout the possessions and you may a strong credit history, in addition to is safer mortgage loan lower than your current you to definitely. A primary upside with a funds-aside re-finance is that it is a simple first-mortgage financing, perhaps not a holiday lien otherwise credit line.

Build mortgage

People are able to use a houses financing to cover homes, strengthening work and you will content, permitting, and other relevant costs having characteristics. Speaking of quick-term loans (constantly regarding the a year) which have higher interest levels. To help you be eligible for a homes financing, you will need to supply the lender the in depth enterprise preparations, records toward subscribed contractor managing the endeavor, about 20% collateral of your house, and you may proof of your ability to settle the borrowed funds (proof of money and a good credit score history).

Owner-creator construction mortgage

If you intend to build your property, a proprietor-creator mortgage ‘s the mortgage to you. Lenders find such borrowers just like the greater risk (the plans takes lengthened and you can stumble on much more issues), thus these financing could be much harder to help you qualify for. You’ll need to demonstrated a detailed construction plan with can cost you to show you might be qualified to do the trick.

While you are this type of finance incorporate a high interest rate, you can recoup the purchase price if your completed investment contributes worthy of to your residence; including, you’ll likely compensate for the better desire with your deals from forgoing a contractor.

Domestic collateral financing and HELOC

Home guarantee funding permits home owners that have guarantee to get into cash of their homes having renovations (or any other needs). Generally, these types of loans where you can tap into their guarantee want a moment lien (or 2nd financial) along with your mortgage. Because these finance try shielded facing their collateral in the home, loan providers you are going to render down prices than simply they will to own your own mortgage.