Ways to get a corporate Mortgage because a keen H-1B Visa Owner

Of many otherwise most of the activities looked here are from our people who compensate all of us. It has an effect on and that affairs we discuss and you can where and how this product looks into a web page. But not, it doesn’t influence the ratings. Our opinions is actually our personal. Here’s a listing of all of our partners and you will this is how we make money.

An enthusiastic H-1B charge holder could find it tough to begin a business together with get the money they need. When getting a corporate options, visa owners should be mindful to follow brand new regulations that use into the visa system to not compromise their H-1B reputation.

Concurrently, when a lender is actually because of the chance of this mortgage, the fresh minimal age of remain on the H-1B system can get count resistant to the borrower. That being said, delivering a business mortgage isnt hopeless, if you can navigate these types of demands.

A close look from the H-1B Visa system

H-1B visas is approved so you’re able to nonimmigrants who wish to realize professions on the You.S. one fall under three chief groups:

Beneath the H-1B charge system, potential employers away from expertise industry workers and you may trend designs have to fill out a work Conditions Software and located a department regarding Labor Qualification. H-1B position try offered for approximately 3 years of these charge holders. This time around months is longer, but generally the visa holder’s total stand can not be more half a dozen years.

There are various legislation that needs to be fulfilled on the H-1B charge program. Among them: New company need introduce and sustain a manager-personnel connection with brand new visa owner. As a result the new workplace is take action the common control off a manager such as for instance choosing, spending, supervising and you can terminating the new H-1B visa proprietor.

Maintaining required employer-personnel matchmaking

Among the pressures one to a keen H-1B charge owner create face when doing a corporate is when so you can demonstrably care for an employer-worker relationships as required by the system. Listed here are one or two programs regarding action that could probably permit them to achieve that:

Build its organization that have a section of administrators

You to definitely option is you to a keen H-1B visa holder could individual and you can benefit their organization, if they are operating and you will treated as an entire-big date worker. In order to be handled as a worker, this new charge proprietor would have to give power over the company so you can a section away from administrators or other alternative party. Also, having charge owners losing within the expertise occupation and you can manner model classes, what they do within its providers perform still have to meet with the general standards of these classifications.

Very own, yet not work with the providers

Several other way more old-fashioned alternative one bypasses the new workplace-employee requirements is to start a business otherwise purchase one to, however work at they. Less than this method, that they had look after the established a position making use of their H-1B company and you will would not be definitely doing work in their team or discover a salary from it.

Recommendations out-of an immigration attorney

Given the minimal pointers available on this subject therefore the rigorous conditions H-1B charge owners need certainly to adhere to, an enthusiastic H-1B charge manager shopping for creating their own organization may want to find counsel of a legal professional who is well-qualified from inside the immigration laws. A keen immigration lawyer might help him or her browse the challenges they are going to deal with in advance of they start the process of delivering a business mortgage . With her business could be an exciting options needed to pursue, in case perhaps not done properly, it may potentially complicate its standing on the H-1B visa system.

Company mortgage capital choices

Fundamentally, a knowledgeable loan to possess a business could be the one having the lowest pricing and greatest terms. Investment time, team qualifications and you will novel residency status will even influence a prospective borrower’s decision. Listed below are three options to consider:

Antique loans

Usually, the initial prevent when seeking to money to have a corporate was an effective traditional lender. Loans generally offer borrowers a decreased rates and best terminology, but they normally tough to be eligible for. Sharing property status at the beginning of a discussion having good bank will save you time. Together with, while each and every bank sets its qualification requirements, a requirement of at least 24 months running a business is typical. A mortgage tends to be a better choice when you’re searching to find a current team instead of start a loans Billingsley AL new you to definitely.

SBA financing

The little Organization Management, or SBA, can make SBA money available because of recognized credit couples. These types of financing is other resource choice a keen H-1B visa proprietor normally think. Judge noncitizens meet the requirements to own SBA fund, however their brief updates would be taken into consideration whenever choosing the chance with the the team.

The newest SBA implies pay a visit to a location office for more information about how the charge standing often apply to the job having an excellent loan. SBA funds can be used to initiate a business otherwise develop a preexisting process. Remember that the business might be located and you can operated regarding the U.S. otherwise its areas.

On the internet lenders

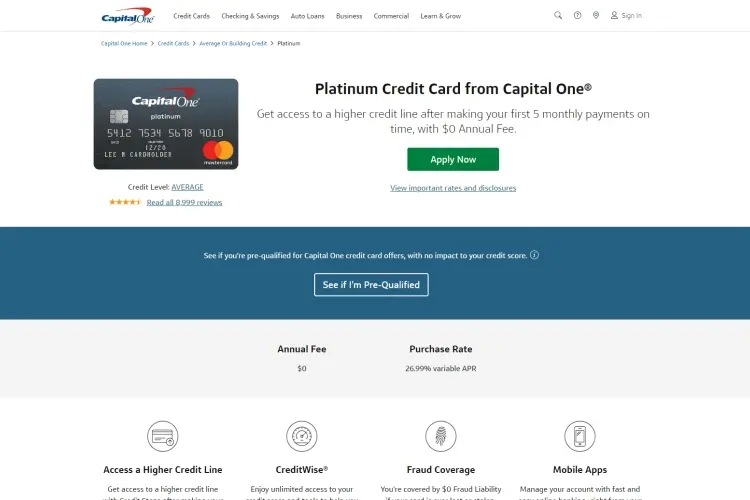

Web business money generally have a whole lot more flexible qualification requirements than simply traditional financial and you will SBA funds. not, their interest cost have a tendency to generally feel higher than the individuals offered by banking companies. Once more, speaking of your property standing and you will whether you are undertaking a business or investing in various other may help get rid of loan providers that are not this new correct fit.

In regards to the blogger: Lisa Anthony try a small-company author within NerdWallet and has more than twenty years from expertise in banking and you will fund. Find out more