When you should score an excellent HELOC just before offering?

Time was everything once you’ve decided one to playing with good HELOC to get another type of house is the best option. If you are intending to sell your residence, you should know all recommendations and you will restrictions for this style of personal line of credit. Prior to using a beneficial HELOC to shop for new house property, think some of the fundamental positives.

Down interest levels: Lenders generally place a high financial price for the an investment property. When you have a great amount of guarantee and you may borrow secured on your own top house, you’ll likely secure reduced cost.

Simpler certification: Using a great HELOC purchasing another residence is always a good risk. Yet not, you could potentially be considered more quickly oftentimes. You are offering your house right up given that collateral, and lots of loan providers notice as the an excellent marker of monetary safety.

Asset maintenance: Home owners, especially those nearing later years, may suffer comfortable with having fun with an excellent HELOC to invest in an alternate domestic. You can create long-term affairs for many who mark off a retirement finance. You will additionally would not like credit away from a crisis money. You can access bucks via your residence’s equity nevertheless keep yourself protected for future years.

Although you might be concerned with taking an excellent HELOC to purchase a good brand new home, you have other choices. Explaining the advantages and disadvantages apply at you myself can assist you finest get ready for people second tips.

Getting a good HELOC can make sense when you are seriously interested in swinging someplace else or happy to downsize to help you a far more in balance house. If you are planning into playing with HELOC to order a unique family, you ought to bundle appropriately. Loan providers will not let you borrow against your home once you have noted they. You will have to safe their line of credit one which just call a representative.

Lenders generally speaking cannot care and attention the manner in which you repay their HELOC. You could start arranging the intends to promote provided your pay it off completely before you romantic on your own very first assets. You might not have the ability to use your house since the equity getting the new HELOC when you no longer get it.

An effective way to replace your profit prior to getting an excellent HELOC

You may have to alter your monetary health before you can imagine playing with a HELOC to order a special family. Saving, to make investment, and you may cutting back with the spending is actually long-identity ventures. Provide your finances a boost one which just score an excellent HELOC so you’re able to get new house on the pursuing the implies:

Song your purchasing: Consider where you invest much of your money. Comment and you may pick this new low-requirements, like eating at restaurants and you can activities. Figuring your expenses at the end of every month normally be noticeable a white for the the best place to tighten your finances.

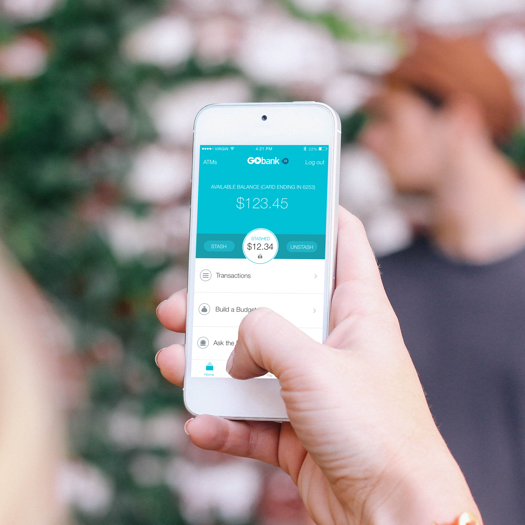

Protect your self on the internet: Mention form notice on your bank accounts and you can playing cards. The companies can then notify you if there is one unusual otherwise skeptical craft. Make an effort to safer your money in advance of having fun with HELOC so you can pick a new domestic. Making certain that debt membership passwords are unique is a good initial step.

Improve your personal deals rates: You might calculate the throwaway income in a number of tips. You’ll need to assess one another your income and you may coupons toward year. Following, you are going to split their savings by the income and you will multiply from the 100. Boosting your fee section gives you better coverage if you use an effective HELOC buying brand new home functions.

Boost your credit history: Eliminate your credit score observe what you are handling. You can access top pricing which have increased credit score and possibly save tens to thousands of cash about overall. Find credit report characteristics that provide soft pulls you try not to accidentally connect with their get.

Using a good HELOC to order a special home is not a quick otherwise effortless choice. If you are searching to many other a means to get ready for the new sizable capital, be connected. All of our home loan consultants will appear at your earnings and provide sense for you’ll be able to steps progressing.

The pros and you will disadvantages of using an effective HELOC having an all the way down fee

Providing cash out of the basic domestic to pay for a straight down payment getting yet another home is high-risk. The benefits and cons of utilizing good HELOC to order a beneficial brand new home disagree for everyone.

Zero balance: You may spend months navigating the new homebuying procedure. If you choose a vintage dollars-away loan rather than playing with an excellent HELOC to purchase another type of family, you could chance settling the loan before you have fun with all of them. You can keep an effective HELOC at the a no equilibrium and avoid purchasing it off up until you will be ready to utilize the cash.

Rotating credit line: You can pay-off and you may recycle their HELOC personal line of credit. Be sure that you you should never meet or exceed your own lay credit limit.

Shedding your house: Adding the first home since equity often harm you if you are not wishing. Your own financial can get foreclose on your own basic assets in the event your next domestic drops using and you also standard in your HELOC.

High rates of interest: You may have to pay highest costs when using a beneficial HELOC buying new home qualities. Weighing the options prior to having fun with HELOC purchasing a different household and determine whether you could potentially do brand new variable interest rates.

You can also safeguards a unique residence’s deposit instead of providing enhance most other domestic. A number of the actions can include talking-to someone that your try near to having let or seeking others. These guidance options are:

Regardless if you’re likely selling eventually, glance at the enough time-title consequences. The single thing that is riskier than just providing an effective HELOC or similar loan is only thinking for a while.

Get a hold of a loan provider you can trust

Build your lifetime easier by the comparing your own possible down-payment choices with this down-payment calculator. If you get a money, our very own mortgage specialists will help walk you through the new prequalifying actions. Within American Money, we know one having fun with HELOC buying yet another family works for many people. I however try and have a look at for every single financial predicament and you will offer guidance installment loans Portland for simple, custom options.